how to calculate tax on uber income

If your annual income is over 37000 then the tax rate. Your tax savings will grow and at the end of each.

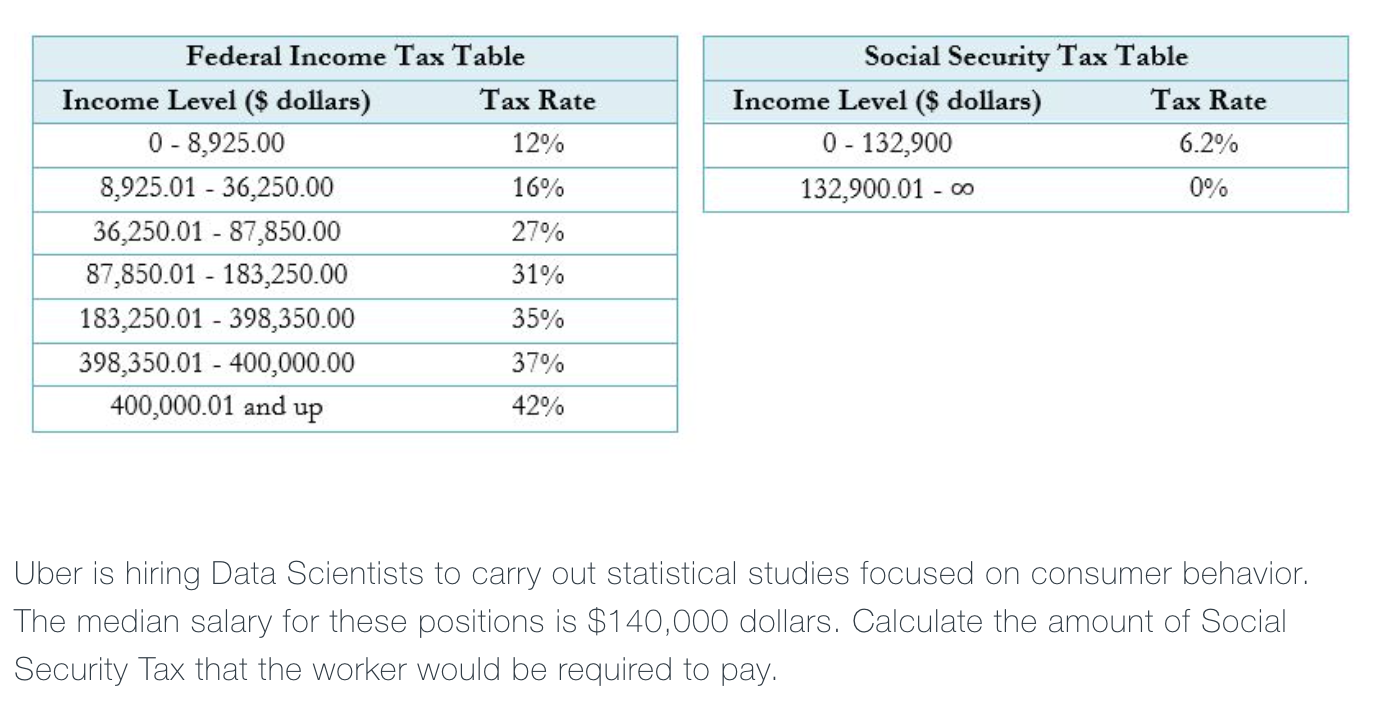

Solved Social Security Tax Table Income Level Dollars Chegg Com

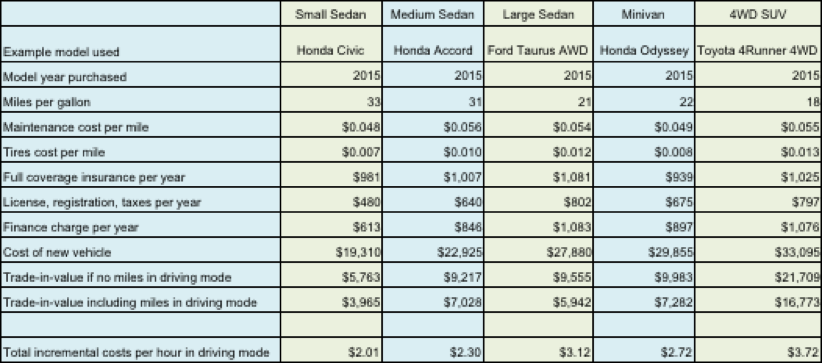

Driver Net GST Liability c 659.

. If youre an Uber driver youll need to declare the income youve generated in the financial year on your tax return. Driver Output Tax Liability b 909. If your annual income is over 18000 and less 37000 then the tax rate is 19 and you can get 675 1-19 54675.

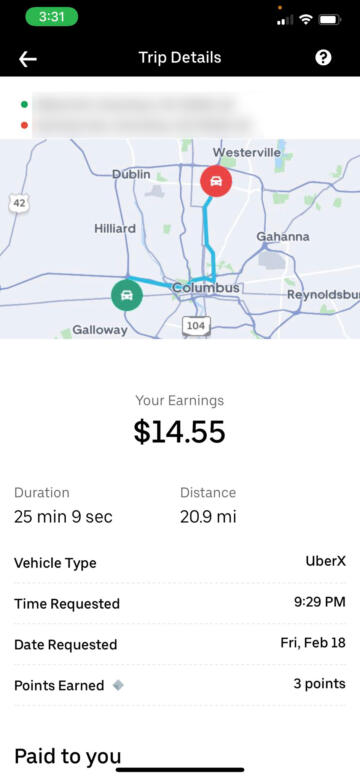

Your 1099-K is an official IRS tax document that includes a breakdown of your annual on-trip gross earnings. Dont spend all of your Uber income. The above rates include the Medicare Levy Each time you get paid from driving put that percentage aside.

UBER OLA Taxify GST and TAX calculatorThe aim of this calculator is to provide tax estimation based on your driving date and quarterly income. Heres an important warning. This includes all money you get from passengers including the Uber commission and the other fees.

Driver Outcome 6591. The tax summary provides a. This form shows the total amount your passengers paid for rides.

Verification of that income will. You should file a Form 1040 and attach Schedule C and Schedule SE to. 100 percent of the tax you paid the previous year or 110 percent if youre a high-income taxpayer.

You earned more than. Well send you a 1099-K if. Thats because were focusing only on the tax impact of your Uber Eats and other.

This is just a simple calculator to see an estimate of your taxes with standard deductions. Im not a tax expert or a professional CPA. A The total amount received after the Service Fee is deducted.

The tenants net income from the rideshare business should be included in the tenants income as self-employment income from a business. For the majority of you the answer is yes If your net earnings from Uber exceed 400 you must report that income. 90 percent of your total tax due for the current year.

This is only calculating income tax on your business profits not the entire income tax bill.

The Impact On Medallion Financial Of Uber Driver Pay Nasdaq Mfin Seeking Alpha

Tax Deductions For Rideshare Uber And Lyft Drivers And Food Couriers Get It Back

Secretive Algorithm Will Now Determine Uber Driver Pay In Many Cities The Markup

Uber Tax Information Essential Tax Forms Documents

/cdn.vox-cdn.com/uploads/chorus_asset/file/13201377/uber_ridester.png)

Uber Driver Salary Is Less Than 10 Hour For Half Of Us Uber Drivers Vox

How To File Your Taxes For Uber Lyft And Other Popular Gig Apps

How To File Your Uber Lyft Driver Taxes Using Turbotax 2021 Youtube

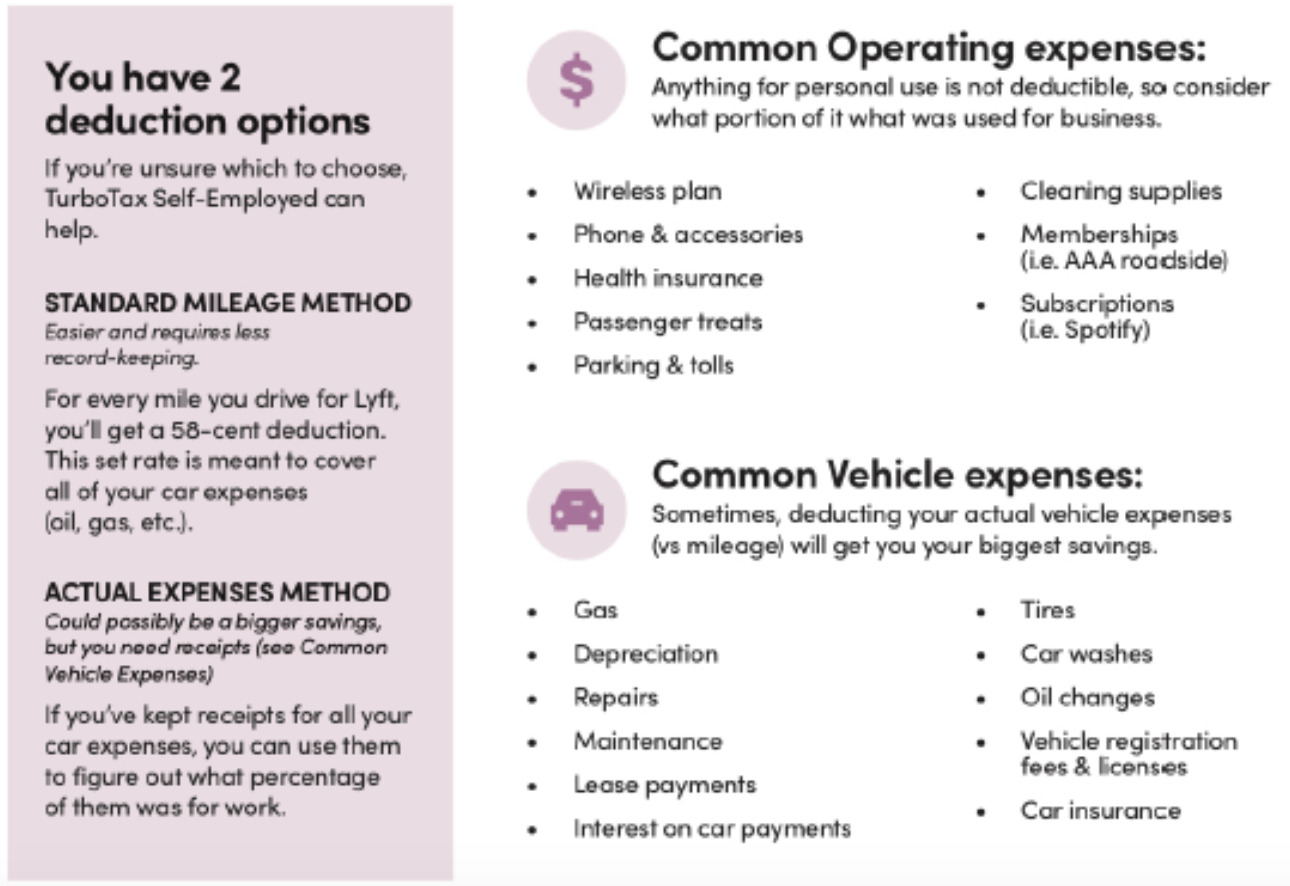

How To Claim The Standard Mileage Deduction Get It Back

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Tax Tips For Uber Driver Partners Understanding Your Taxes Turbotax Tax Tips Videos

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Tax Deductions For Rideshare Uber And Lyft Drivers And Food Couriers Get It Back

How To Read Uber Tax Summary 2019 Explained Information Provided On Uber Tax Summary For Drivers Is Very Confusing This Video Explains All The Amounts On Uber Tax Summary In

Uber Taxes Explained How To File Taxes For Uber Lyft Drivers Updated For 2020 Youtube

Tax Calculator For Uber Apk For Android Download

Uber S Elaborate Tax Scheme Explained Fortune

Uber Tax Forms What You Need To File Shared Economy Tax

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

How To Report Income From Uber In A Canadian Tax Return Youtube